Indispensable Edge: Multi-Currency Support for Aircraft Lessors

In aircraft leasing, transactions span continents and involve diverse financial ecosystems with bespoke regulatory requirements. For lessors, the ability to manage multiple currencies in their asset management system is not merely a convenience—it’s a fundamental necessity, enabling seamless operations, enhanced financial clarity, and stronger client relationships in a global market.

Flexibility to issue rental invoices and receive payments in various currencies

Lessors require the ability to issue invoices and receive payments in various currencies, such as US dollars, Euros, British Pounds (GBP), or Renminbi. This straightforward capability ensures that lessors can cater directly to the preferred operational currencies of their airline clients, streamlining payment processes.

Beyond single-currency transactions, a more complex yet vital use case involves splitting a single rental obligation across two or more different currencies. For example, a monthly rental of $1 million might be split, with $200,000 to be invoiced and settled in British Pounds, and the remaining $800,000 in US dollars. This capability necessitates creating separate rent schedules for each currency and the ability to receive payments into different bank accounts corresponding to each currency.

A critical functionality is the need to override the default bank account at the rent schedule level, rather than on every individual invoice, to ensure configuration efficiency and accuracy for various currencies.

Multi-currency functionality dramatically impacts financial reporting and accounting

Lessors need to generate receivables reports across their entire portfolio in a base currency, typically US dollars, regardless of the original transaction currency. This demands flexible currency conversion rates, whether specified periodically, loaded daily based on exchange rates, or fixed for the entire lease term.

While a system should maintain a US dollar equivalent for every transaction, the exact handling of General Ledger (GL) transactions—whether they flow through in foreign currency or are converted to US dollars—and the subsequent accounting for foreign currency gains and losses are critical considerations. The expectation is that integrated accounting systems should ideally manage these complexities, simplifying the process for the core leasing platform.

Handling payments in various currencies introduces another layer of complexity

Lessors face scenarios where an invoice is issued in a foreign currency (e.g., British Pounds), but the cash might be collected in US dollars, or conversely, both invoicing and collection occur in the same foreign currency. This requires the asset management system to accurately track payments while capturing FX gains and losses, apply them against invoices, and account for any variances due to exchange rate fluctuations between the invoice date and payment date.

Robust and globally aware asset management system

Strategically, multi-currency support serves as an “entrance ticket” in customer engagements, as many potential clients inquire about this capability early on. While current multi-currency lease volumes for some lessors might be low, any asset management software that handles this functionality signals a robust and globally aware system.

The foundational infrastructure, including currency rate tables and invoice-level conversion logic, is also important to have in place, paving the way for further development of this indispensable feature. Implementing this feature ensures that aircraft lessors remain competitive and adaptable in a dynamic international market.

Aeris ASSET

Lessors trust us to provide a highly secure and scalable cloud-based solution to streamline communication across asset management, marketing, trading and finance. With Aeris ASSET, lessors can streamline cash collection and preserve asset values by digitizing contract, finance and technical management of aircraft. With advanced analytics, lessors spend less time chasing information and more time making decisions.

Beyond Fragmentation: Centralized Intelligence for a Strategic Edge in Fleet Management

Navigating the complexities of aircraft fleet management presents a formidable challenge for airlines today. The sheer volume of critical data, combined with often older generation systems of record, creates significant operational hurdles and limits strategic agility. A thoughtful system that would integrate and become the information hub for all fleet decisions, is not just beneficial, but essential for airlines seeking to optimize their operations and maximize asset value.

Consider these critical areas where current approaches fall short and how a comprehensive solution can revolutionize fleet management:

Ultimately, a centralized, data-driven platform is not just an operational tool; it is paramount for streamlined contract management, securing more favorable outcomes, and unlocking the full potential of an airline’s fleet through unparalleled oversight and strategic foresight. This shift transforms fleet management from a series of reactive tasks into a proactive, strategic advantage.

The Pervasive Problem of Data Fragmentation:

- Aircraft fleet data is frequently decentralized and scattered across disparate systems.

- Vital information, from detailed lease contract terms to technical data, often exists in unstructured formats.

- Aircraft maintenance may be handled by one MRO application (e.g., AMOS), while engines are managed in entirely separate, dedicated databases, with other crucial data points residing in additional systems.

- This lack of a unified, single source of truth prevents a comprehensive, real-time overview of the entire fleet.

- The consequence is inefficient processes, a significant absence of real-time insights, and a reliance on manual efforts for tasks such as activity reporting to lessors, which might be handled independently by different internal teams.

The Strategic Imperative for Data Centralization and Cost Optimization:

- A strong and critical need exists for consolidating and centralizing all fleet-related data and information into a single, unified solution.

- This centralization is not merely about tidiness; it enables the transformation of large, complex metrics into clear, actionable costs per aircraft.

- Imagine a system that accurately compiles all costs associated with an aircraft, including financing, maintenance, and even direct operating costs, all seamlessly flowing into a single system.

- Such a solution facilitates a deeper, more accurate analysis of aircraft ownership costs and route profitability, which is vital for strategic decision-making and for increasing overall aircraft utilization.

- Moving beyond reactive, on-demand analysis of individual aircraft, a centralized platform provides the capability for proactive supervision of the entire fleet, fostering greater control and foresight.

Revolutionizing Fleet Planning with Advanced Forecasting and Simulation:

- Traditional fleet management often relies heavily on historical data and demands manual, on-demand analysis for crucial tasks like lease extensions.

- However, a sophisticated solution can deliver robust forecasting capabilities, projecting the future state of the fleet rather than merely recounting its past.

- This includes powerful simulation functionalities, particularly invaluable for lease extensions. These simulations enable airlines to adopt a proactive approach, initiating negotiations and strategic planning at least 18 months before a lease is set to conclude.

- These forecasts gain even greater depth and accuracy when critical financial elements such as revenue, crew costs, and fuel expenses are integrated, providing a truly holistic financial picture.

- This proactive stance is paramount in today’s market, where negotiating conditions with lessors when negotiating new leases or extension terms.

Streamlining End-of-Lease (EOL) and Contract Management:

- Managing complex end-of-lease (EOL) provisions—such as coordinating engine swaps at return to maximize benefit or handling intricate lump sum payments for engine maintenance reserves—is frequently managed through ad-hoc, error-prone Excel calculations.

- A structured system can significantly optimize returns by providing a systematic way to manage these provisions, moving away from fragmented calculations.

- Such a platform helps in dynamically assessing lease terms relative to current market conditions, acknowledging that what constitutes a “good” or “bad” contract is always relative to the prevailing moment and market dynamics.

- Centralized contract management ensures that all appropriate information is securely consolidated into a database and is accessible on a need-to-know basis, thereby streamlining operations and reducing the complexities often associated with negotiations, especially those concerning the movement of engines between aircraft.

- Furthermore, the solution supports strategic decisions regarding sale and leasebacks (SLBs) by providing the necessary data for capital expenditure analysis and the selection of optimal SLB opportunities to help with cash flow.

Empowering Strategic Decisions and Operational Excellence:

- By centralizing every aspect of fleet management, an airline gains comprehensive oversight, leading to profoundly more informed decisions regarding fleet additions, replacements, and effectively mitigating the impact of unexpected delays.

- The ability to rapidly analyze and adjust plans for lease extensions or new leases, taking into account global economic scenarios and internal financial metrics (such as WACC for NPV and total cashflow), alongside technical assessments of aircraft condition, is drastically enhanced.

- Ultimately, a centralized, data-driven platform is not just an operational tool; it is paramount for streamlined contract management, securing more favorable outcomes, and unlocking the full potential of an airline’s fleet through unparalleled oversight and strategic foresight. This shift transforms fleet management from a series of reactive tasks into a proactive, strategic advantage.

Aeris AIRLINE

The ultimate asset lifecycle management software designed for airlines.

Our end-to-end asset management automation, advanced analytics, and seamless integration with your current IT systems enable you to manage financial, legal, and technical obligations with unparalleled efficiency and cost synergies.

Aeris AIRLINE empowers your Fleet Management, Finance, Tech, and Legal teams with proven solutions that streamline the entire aircraft lifecycle—from phasing in to managing and phasing out your aircraft.

LeaseWorks Adds GOAL as Newest European Customer

Stamford, CT – June 16, 2025 – LeaseWorks®, a Portside company, announced that GOAL (German Operating Aircraft Leasing), a joint venture between KGAL GmbH & Co. KG and Lufthansa AG, as its newest European customer.

GOAL will adopt LeaseWorks’ Aeris AssetTM and Aeris MATCHTM products to digitize the firm’s asset and customer management operations, while becoming LeaseWorks’ first beta customer for the Aeris CFX Forecasting tool.

“In a highly competitive market, I am proud that LeaseWorks stood out for our ease of use, forward-thinking product roadmap and the way we partnered with the GOAL team — listening closely, tailoring our approach and showing true adaptability to their evolving needs around Lease Diary, Asset Forecasting and LLP Mini Funds,” says Haseem Vazhayil, Founder, LeaseWorks.

As a long-established aircraft leasing platform with a diverse portfolio of commercial aircraft across global markets, GOAL is focused on disciplined asset selection, long-term relationships, and a reputation for quality in aircraft leasing. The LeaseWorks products will enable GOAL to automate activities across commercial, finance, contract and technical operations, while collecting actionable intelligence to make day-to-day decisions with real-time data.

GOAL’s co-Managing Director, Vicente Alava Pons, states that “GOAL’s digital initiatives are designed to promote transparency and collaboration across our firm, as well as with investors and partners, helping us scale our operations. The partnership with LeaseWorks will help us improve our processes and data transparency across the organization while putting new forms of innovations, such as mobile and artificial intelligence (AI) capabilities, in the hands of our employees.”

“We look forward to supporting the GOAL team in their digital journey, deepening our collaboration by embedding our state-of-the-art tools that will enhance GOAL’s processes to deliver exceptional results for their customers,” says Vazhayil.

About GOAL

GOAL Aircraft Leasing, Germany’s leading aircraft asset manager and ranked in Top 15 by ISHKA, has a proven track record in structuring complex leasing deals and delivering strong value to our investor partners. Our disciplined investment approach and robust risk management make us a trusted and competitive partner.

With a global footprint and deep industry relationships, we provide strategic insights driven by market trends, regulatory developments, and emerging technologies. Our expert team offers tailored leasing and financing solutions to airlines, along with a full suite of services for investors. https://www.goal-leasing.com/en/

About LeaseWorks

LeaseWorks®, a Portside company, provides cloud-based products and services to the aviation leasing community, with solutions for both lessors and airlines. Aeris MATCH™ helps lessors more quickly and effectively deploy their aviation assets with airlines around the globe. Aeris ASSET™ allows both lessors and airlines to manage the intricate details of aviation leases. These are the first two of a suite of products that will constitute a full-life-cycle portal for managing leased aviation assets. www.leaseworks.aero

Contact

For more information, contact:

+1-203-663-3999

LeaseWorks Enhances Crestone Air Partners’s Digital Strategy

DUBLIN – January 14, 2025 – LeaseWorks®, a Portside company, announced a new partnership with Denver-based Crestone Air Partners, Inc. (“Crestone”) to enhance the asset manager’s digital strategy.

“As Crestone Air Partners continues to grow its prominent aviation asset management platform, LeaseWorks’ software will help power its growth by leveraging advanced analytics and insights for decision-making, as well as automating business processes across the organization,” says Haseem Vazhayil, President, LeaseWorks.

Crestone will use Aeris MATCHTM to automate commercial activities across trading, marketing and collecting market intelligence to make commercial decisions with real-time data. Once aircraft are purchased or placed on lease, Aeris ASSETTM will automate contract, finance and technical activities, ensuring a smooth flow of information to enforce contract terms, collect on invoices in a timely manner and preserve asset values.

Crestone’s CEO, Kevin Milligan, states that “access to relevant and timely information is essential to our success as an asset manager. These systems will not only help us manage our growing asset base but will also scale alongside us as we continue to expand. We’re excited to partner with LeaseWorks to improve our processes, ensuring better organization and greater efficiency in managing our assets. This partnership aligns perfectly with our commitment to innovation and operational excellence as we move forward.”

“We look forward to working with Kevin and his talented team at Crestone to support their digitization journey, assisting to embed digitization across their operations to deliver exceptional results for investors and customers,” adds Vazhayil.

About Crestone Air Partners, Inc.

Crestone Air Partners, Inc. (CAP) invests in commercial jet aircraft and the engines that power them on behalf of our capital partners. We are a full-service aviation asset management platform with a diverse portfolio of aircraft and engines leased to airlines globally. We target transactions in the secondary market, focusing on the last decade of the asset lifecycle. We take a collaborative approach with our clients by offering flexible lease terms tailored to our customers’ requirements. Crestone brings unique value to transactions by drawing on the expertise and capabilities of interrelated aviation specialist subsidiary businesses across the Air T family (airframe material sales, landing gear leasing, engine material sales, disassembly, and aircraft storage). Crestone is headquartered in Denver, Colorado, and is a wholly owned business unit of Air T, Inc. holding company (NASDAQ: AIRT). Additional information can be found at: www.crestoneairpartners.com.

About LeaseWorks

LeaseWorks®, a Portside company, provides cloud-based products and services to the aviation leasing community, with solutions for both lessors and airlines. Aeris MATCH™ helps lessors more quickly and effectively deploy their aviation assets with airlines around the globe. Aeris ASSET™ allows both lessors and airlines to manage the intricate details of aviation leases. These are the first two of a suite of products that will constitute a full-life-cycle portal for managing leased aviation assets. www.leaseworks.aero

Contact

For more information, contact:

+1-203-663-3999

LeaseWorks Facilitates Digitization of AviLease’s Commercial and Asset Management Operations

Saudi Arabian Aviation Innovator Alters Lessor Competitive Landscape by Embracing Technology to Propel Its Growing Platform

ISTANBUL – September 23, 2024 – LeaseWorks®, a Portside company, announced at the ISTAT EMEA 2024 conference its partnership with a new customer, AviLease, the rapidly expanding global aircraft lessor.

AviLease has a two-year strong track record of remarkable contributions to supporting the goals of Saudi Vision 2030 that aims to propel the expansion of the Kingdom’s homegrown aviation sector. AviLease has prioritized digitization as a strategic lever in strengthening its disruptive business model to strengthen its agility and operational efficiency further and lead by creating industry-leading shareholder value.

“Industry innovators, like AviLease, are rapidly altering the competitive landscape by investing in partnerships with software companies to integrate specialized expertise and technology solutions,” explains Haseem Vazhayil, President, LeaseWorks. “By embedding digitization in its corporate DNA, AviLease quickly set itself apart from the competition, establishing an operating model that challenges the old ways of leveraging analytics and insights for decision-making.”

As part of its innovative digitization initiative, AviLease has implemented LeaseWorks’ flagship products – Aeris MATCHTM, for digitizing commercial operations, and Aeris ASSETTM, for managing finance, contract and technical aircraft management.

AviLease Chief Executive Officer, Edward O’Byrne, says: “Integrating advanced digital tools is central to our operational philosophy, as we aim to draw on real-time information to achieve higher efficiencies and optimization. With Saudi Arabia at the forefront of embracing digital tools in line with the goals of Vision 2030, our digital transformation strategy will contribute to long-term value creation. The new partnership will help us achieve higher levels of customization and faster delivery of solutions across our value chain.”

“We are proud to partner with AviLease, whose leadership has demonstrated a clear vision by digitizing their commercial and asset management operations,” adds Vazhayil. “We are excited to work with such a talented team to optimize costs and bring the benefits of automation to their platform as they continue to scale.”

About AviLease

AviLease is a global leader with a two-fold mandate. As a full-service commercial aircraft lessor, AviLease is passionately dedicated to delivering tailored fleet solutions to our esteemed airline partners. Whether engaging in leasing, trading, or asset management, our seasoned international team of industry experts is ready to provide unparalleled assistance.

AviLease is headquartered in Riyadh, Saudi Arabia, since its establishment in 2022, AviLease has rapidly expanded its portfolio, featuring new technology Airbus and Boeing fleets.

AviLease is strategically positioned as an industrial, disciplined investor here to stay for the long-term. Our approach at AviLease integrates stable financial returns for our shareholders with sustainable country-level impact. www.avilease.com

About LeaseWorks

LeaseWorks®, a Portside company, provides cloud-based products and services to the aviation leasing community, with solutions for both lessors and airlines. Aeris MATCH™ helps lessors more quickly and effectively deploy their aviation assets with airlines around the globe. Aeris ASSET™ allows both lessors and airlines to manage the intricate details of aviation leases. These are the first two of a suite of products that will constitute a full-life-cycle portal for managing leased aviation assets. www.leaseworks.aero

Contact

For more information, contact:

+1-203-663-3999

Time. Kills. Deals.

If you’re an aircraft lessor, you already know that delays in each stage of a marketing or trading deal decreases the chances of your firm being first to the finish line. Delays in delivering the client the information they need open the door for a fast moving competitor to take the opportunity away from you!

Let’s break it down.

Here are some of the circumstances that put deals at risk:

- Accelerate gathering deal requirements

- Quickly match assets

- Streamline process and approvals

Accelerate gathering deal requirements

One of the most significant challenges in placing or trading aircraft is the time-consuming process of gathering deal requirements. These delays can slow down the entire transaction, causing you to miss out on valuable opportunities.

For commercial teams, time is of the essence. Structuring the information flow well can help you centralize all the key information in the right place at the right time. When that process is digitized, software systems can alert for missing information, automatically notifying colleagues who may play a supporting role in moving deals forward.

By utilizing a software product like AerisMATCH, lessors can streamline their deal process, ensuring that critical information is centralized and there is 100% transparency around what it takes to move deals forward. This starts even before making contact with a customer. For example, understanding customers’ fleet structure, leasing affinity, and existing lease expirations can save lessors time by narrowing down their best prospects for aircraft and making sure deal team members are in the information flow in real time.

Quickly match assets

In aircraft leasing, customer requirements are often bespoke. While engines may be more uniform than aircraft, there are still considerations of thrust settings and remaining green time, among other aspects. This puts lessors in the necessary position of finding a match within their asset portfolio or analyzing the feasibility and cost of modifying an existing asset to meet the needs of the deal, which is a time-consuming process. Having a deep understanding of the assets in the portfolio, including specific characteristics and availability, provides key insights to lessors’ teams.

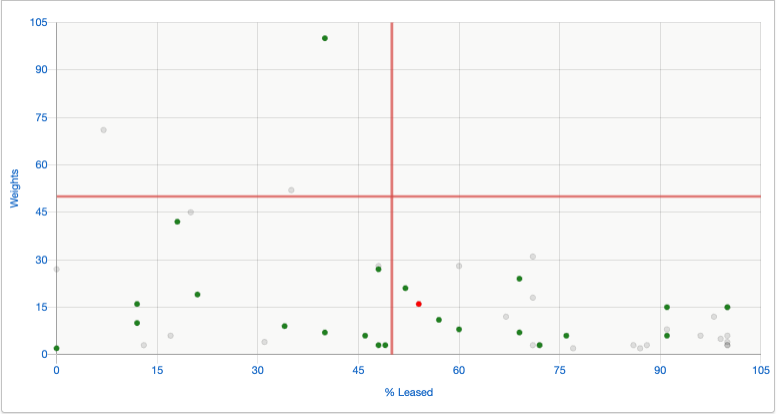

LeaseWorks has a widget that lets lessors select any aircraft variant in their fleet and then generate a chart that shows the degree of match with each of the world’s airlines. This allows lessors to quickly visualize the “magic quadrant,” where the degree of match is strong and the share of leased aircraft in customers’ fleets is high. Additionally, the analytics help lessors find white space opportunities (airlines where that aircraft is not currently marketed, but could be good homes for them).

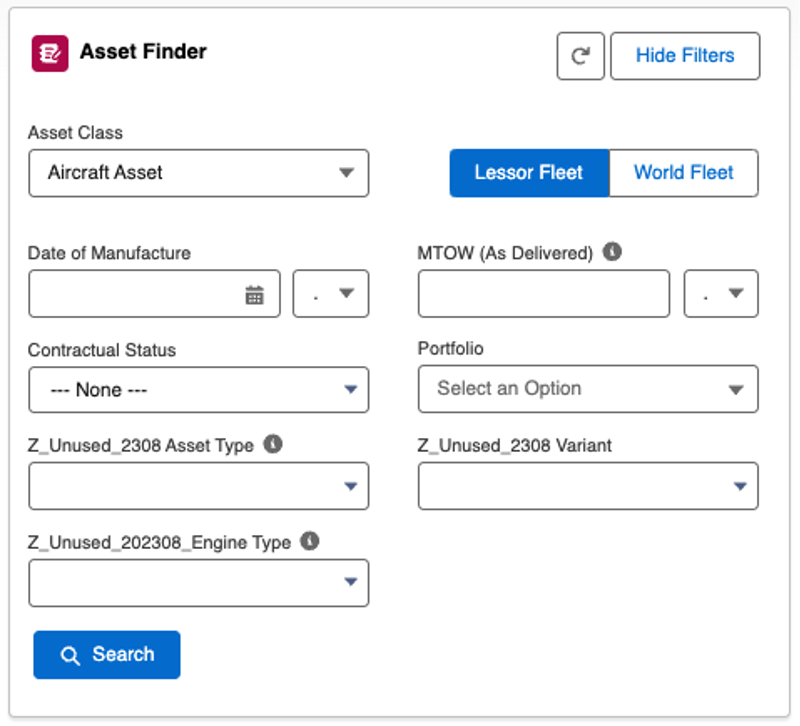

On the flip side, lessors may be starting with the customer requirements and trying to find the closest fit within their fleet. LeaseWorks’ asset finder lets lessors search their fleet, or even the global fleet, for available aircraft that can be modified or even purchased to meet the need.

Streamline process and approvals

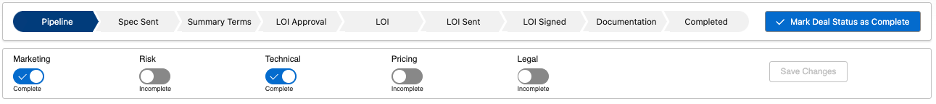

Approvals are simply a series of check boxes that all required information has been gathered. Often an approver is tasked with making sure that “all the boxes have been ticked” but has to chase many people in different departments to ensure information integrity before approving a transaction or LOI. By eliminating the time wasted with incomplete requests, managers and executives can save valuable time and costs.

Digitizing and automating the sales process spawns the possibility of streamlined approvals

When “ticking the boxes” digitally, lessors can let their systems ensure information integrity and approve or deny a request, and send out notifications before a human can even finish reading an email subject line. It can also verify that numbers are within a prescribed range, that assets in the deal are available, and even calculate projected revenue or profit. Many LeaseWorks customers have built these “validations” into their implementations. One customer has every single phase of their deal process ending in a validation that allows the user to move the deal along to the next step or sends them back to flesh out the details.

Digitizing the sales process also provides an opportunity for automated alerts whenever action is required from any team member, including management. With LeaseWorks, lessors’ teams can send alerts by email, through the mobile app, within the desktop app, or through Slack.

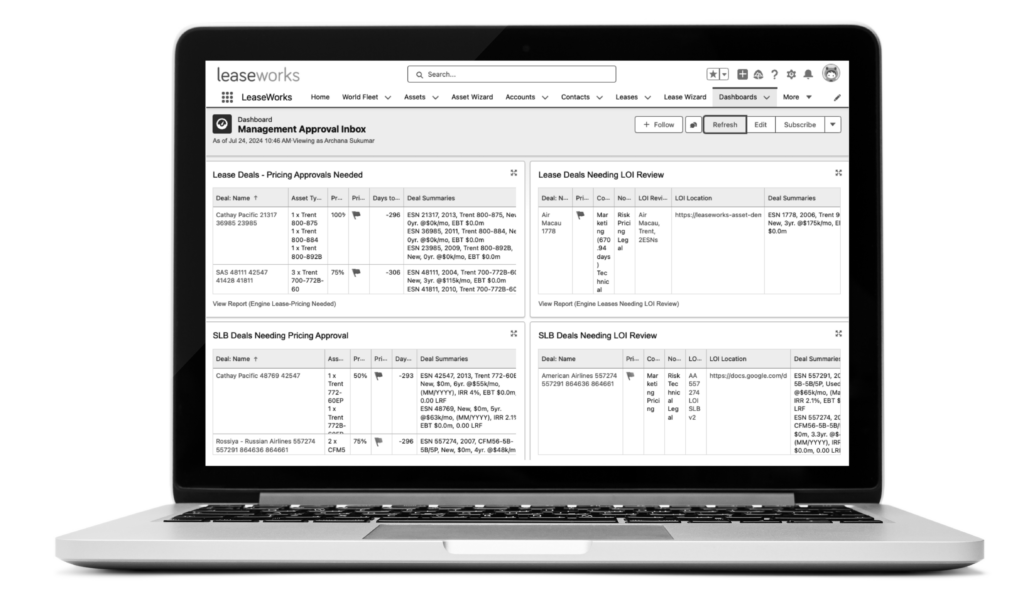

Management dashboards are another aspect of enhancing lessors’ digital process. They provide a real time overview of what needs to be done in the near term, and what is critically late. Dashboards offer on-demand visibility and insight. Instead of waiting for weekly meetings or monthly reports, they deliver up-to-date information to instantly track progress and changes in operations.

Dashboards save time and resources. Immediate access to information allows lessors to make swift decisions and take prompt actions. They let lessors’ teams monitor portfolio performance in real-time, and help them track progress, meet goals, and quickly detect portfolio performance issues.

Time. Kills. Deals.

In the competitive world of aircraft leasing, time is a critical factor that can help you win deals. Streamlining deal requirements gathering, matching assets, and navigating the approval processes can all significantly improve the success of a transaction. Leveraging advanced tools and integrated data sources, such as AerisMATCH from LeaseWorks, can streamline these processes, providing lessors with the agility and efficiency needed to stay ahead of the competition.

By automating routine checks and validations, lessors can reduce bottlenecks and ensure that deals progress smoothly and quickly. Understanding the importance of timely actions and utilizing the right tools can help mitigate the risks associated with delays, ultimately leading to more successful outcomes.

In the end, the ability to act swiftly and decisively can set successful lessors apart in the market. By embracing digital transformation and data integration, lessors can improve decision-making and help win deals faster in the market. Remember, in this fast-paced industry, time really does kill deals—so make every second count.

LeaseWorks and Portside Join Forces

Acquisition to Create Enterprise Software Powerhouse Serving Clients in Aviation

Stamford, Connecticut – August 15, 2024 – LeaseWorks®, a leading provider of innovative software and digital solutions for the aviation industry, announced that it had been acquired by Portside, a leading innovator in technology and software solutions for business and government aviation.

The acquisition extends Portside’s suite of integrated, cloud-based software solutions for business aviation operators with LeaseWorks’ cloud-based products and services, including the AerisTM suite of software solutions, designed specifically for aircraft lessors and airlines. The transaction also signifies Portside’s first venture into the aircraft leasing space.

“Portside shares LeaseWorks’ vision for the aircraft leasing market – to build a software company of scale that will be a transformational force in the industry,” commented Haseem Vazhayil, LeaseWorks CEO. “With Portside’s investment, we’ll be able to further enhance our market-leading position as an enterprise software powerhouse, meeting the diverse needs of clients across the full spectrum of the aviation community.”

”LeaseWorks’ cutting-edge technologies and best-in-class customer service for aircraft lessors significantly advances our goal of providing a single system of record to aircraft owners and operators,” said Alek Vernitsky, Portside CEO. “Our customers’ view of profitability will be greatly enhanced with the full visibility of aircraft lifecycle management, and we are excited to have LeaseWorks in the Portside family.”

Portside is backed by Vista Equity and Insight Venture Partners, two preeminent U.S. private equity firms that specialize in software investing. The backing of these institutions is expected to generate significant opportunities to scale LeaseWorks’ business, enabling both organic and inorganic investments as well as benefiting the company’s operations through the added expertise and support from Portside.

“This transaction is a testament to the hard work, dedication, and trust our team has been privileged to bring over the years to both our customers and the industry. Together with Portside, we will continue to deliver the utmost dedication, unmatched expertise, and highest quality of service to our customers, while leveraging growth opportunities to scale mutual operations,” concluded Vazhayil.

About Portside

Portside, Inc. is a premier provider of modern software solutions for the aviation industry. Portside’s cloud-based suite of products is designed to support all aspects of flight operations, including scheduling and record keeping (Avianis, Takeflite, BART and PFM product lines), safety management (Baldwin), fleet and crew optimization (Portside Optimizer), data sharing, reporting and analytics (Portside Owner Portal / Budget & Planning Dashboard), crew recruiting (Staffing Marketplace), and trip planning (Portside Trip Assist). Portside supports over 1,000 customers in 40+ countries, including passenger and cargo airlines, aircraft lessors, operators of business aircraft and helicopters, medevac, industrial and government fleets, as well as fractional ownership programs. www.portside.aero

About LeaseWorks

LeaseWorks®, a Portside company, provides cloud-based products and services to the aviation leasing community, with solutions for both lessors and airlines. Aeris MATCH™ helps lessors more quickly and effectively deploy their aviation assets with airlines around the globe. Aeris ASSET™ allows both lessors and airlines to manage the intricate details of aviation leases. These are the first two of a suite of products that will constitute a full-life-cycle portal for managing leased aviation assets. www.leaseworks.aero

Contact

For more information, contact:

+1-203-663-3999

Mamoun Kuzbari

Expanding the LeaseWorks relationship accelerated and streamlined the digital transformation initiative effort at Novus and streamlined the decision-making process across the technical, contracts, finance and commercial teams.

David Moreno

The LeaseWorks MRO collaboration product has made shop visit management efficient and transparent by streamlining communication with our MRO partners.

Donna Marie O’Neill

With LeaseWorks, we now have the ability to automate our invoicing and generate on-demand management reports without manual processes.